Redeemable Convertible Preference Shares

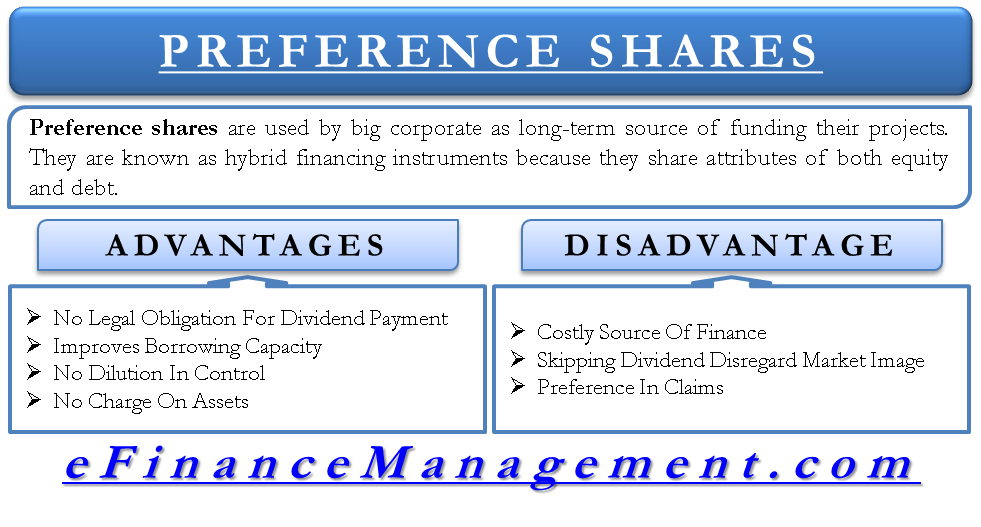

Unlike a common stock which simply represents ownership in a company and does not carry any conversion or redemption features a convertible redeemable preferred stock can be transformed in many ways.

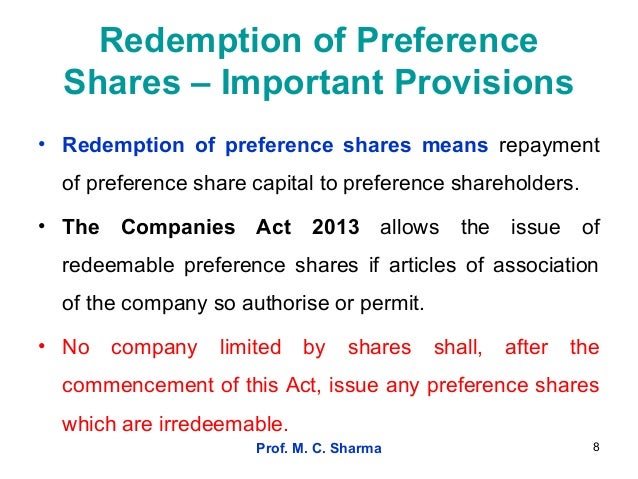

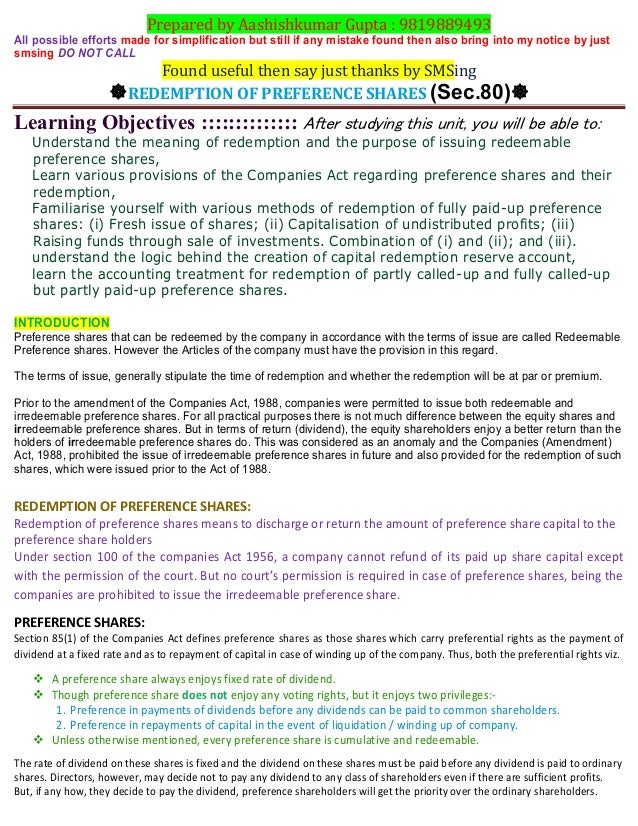

Redeemable convertible preference shares. Only fully paid up redeemable preference shares may be redeemed when there are profits available for such redemption subject to statutory exceptions and a prescribed notice of redemption must be lodged with acra. In order to determine whether a preference share constitutes a financial liability equity or a compound instrument containing elements of both it is necessary to analyse the terms relating to redemption and the payment of dividends i e. The most universal form of preference is a liquidat. Convertible or redeemable preference shares are issued according to the terms set by the company at the time of subscription.

The terms redeemable shares and convertible shares refer to different types of preferred stock. Redeemable preference shares preference shares with a buy back option the company may buy back the preference shares from the holder at a fixed price either at the option of the holder or of the company. Convertible redeemable preferred stock is an interest bearing investment with many complex features. If a preferred stock is redeemable it means that the issuing company can exchange those shares.

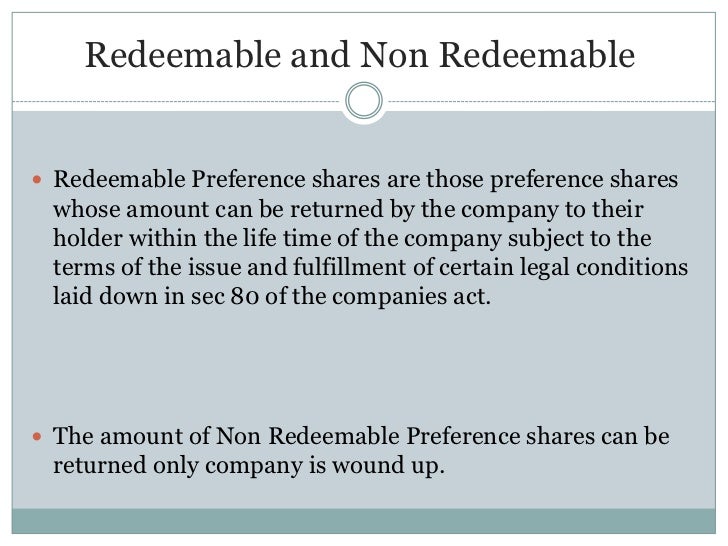

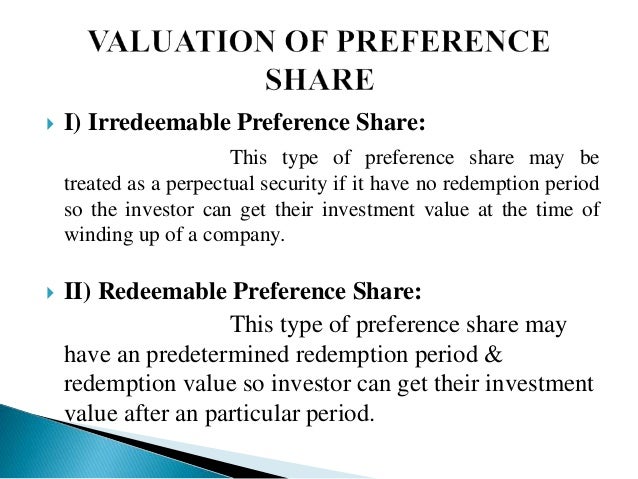

Irredeemable preference shares are those preference shares that cannot be bought back by the issuing company till the company is a going concern and in existence. Redeemable preference shares are those shares which are redeemed or repaid after the expiry of a stipulated period. As described in other quora questions preferred shares are shares of stock in a company that have certain additional rights that are superior to or come before other shares hence a preference. Among many others redeemable and convertible are the two special types of preference shares.

However some restrictions apply to redemption. With a convertible redeemable share the investor can exchange the stock for common stock in the company. Redeemable preference shares are those preference shares that can be bought back by the issuing company within its predetermined maturity period. Redeemable preference shares are those shares where the issuer of the share has the right to redeem the shares within 20 years of the issuance at pre determined price mentioned in the prospectus at the time of issuance of preference shares and before redeeming such shares the issuer shall assure that redeemable preference shares are paid up in full and all the conditions specified at the time.