Malaysia Financial Crisis 2008

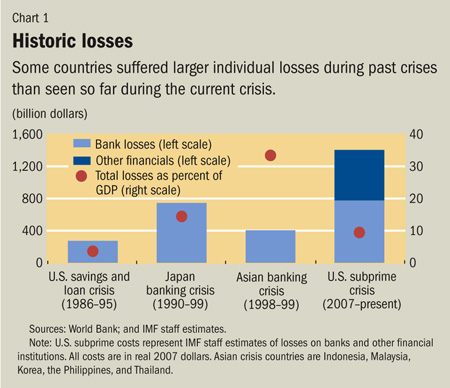

Bank negara malaysia also managed the financial sector well following the bitter experience of the asian financial crisis and hence non performing loans as a share of total loans fell to 2 2 in 2008 and remained at roughly that level in the first two quarters of 2009.

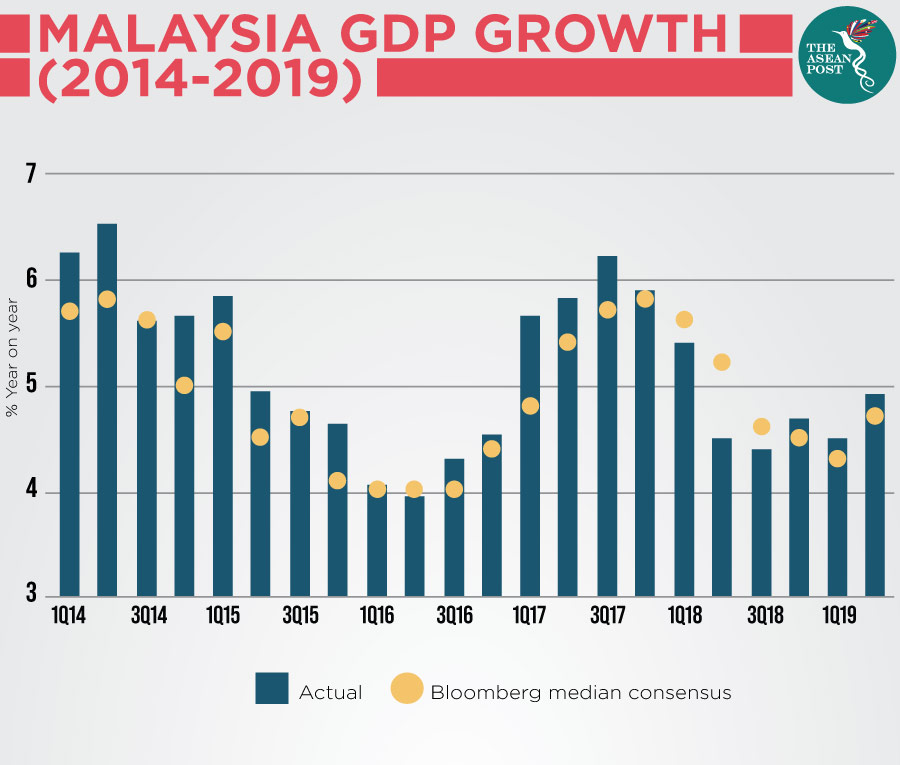

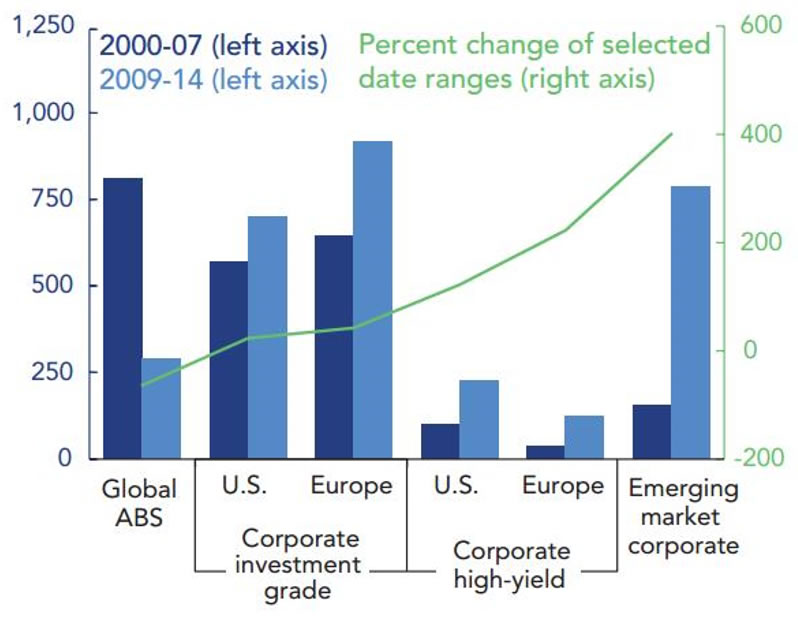

Malaysia financial crisis 2008. Commodity prices in the second half of 2008 saw malaysia s gdp moderate to 0 1 in the final quarter of 2008. Following the 2008 09 global financial crisis that especially hit the united states and europe many hundreds of billions of dollars rushed to emerging markets including malaysia in search of. The financial crisis in malaysia in mid may 1997 the thai baht came under severe pressure from speculative at tacks. Us 2 5 trillion of government debt and troubled private assets were purchased by the federal reserve and european central bank resulting in the largest liquidity injection into the credit market and the largest monetary policy action in world history.

Real estate to plummet damaging financial institutions globally culminating with the bankruptcy of lehman brothers on september. This study is an attempt to explore the relative performance of shariah and non shariah portfolios at bursa malaysia during the global financial crisis from 2007 through 2008. Throughout the period of the global financial crisis underpinned by a strong financial sector and negligible exposure to subprime related assets and affected counterparties. Fortunately for some countries they were able to recover from the economic plague.

Bank negara malaysia s the central bank of malaysia immediate response was to intervene in the foreign exchange market to uphold the value of the. Malaysia and some asean countries will be able to overcome the global financial crisis because their economies are resilient supported by pro growth and proactive policies a visiting don said. The ringgit was also not spared and came under severe selling pressure.