Redeemable Convertible Preference Shares Debt Or Equity

:max_bytes(150000):strip_icc()/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

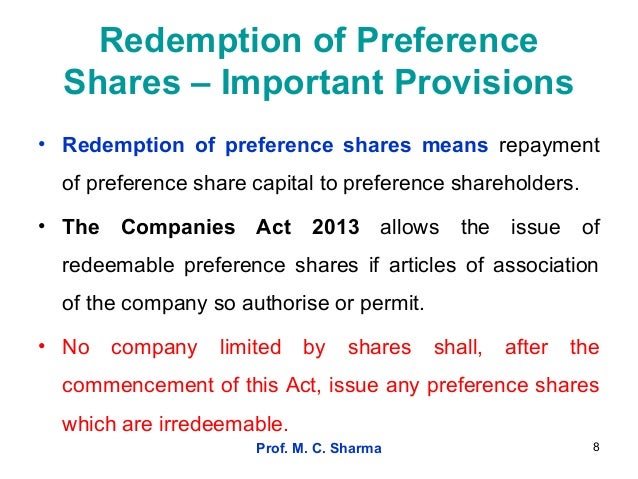

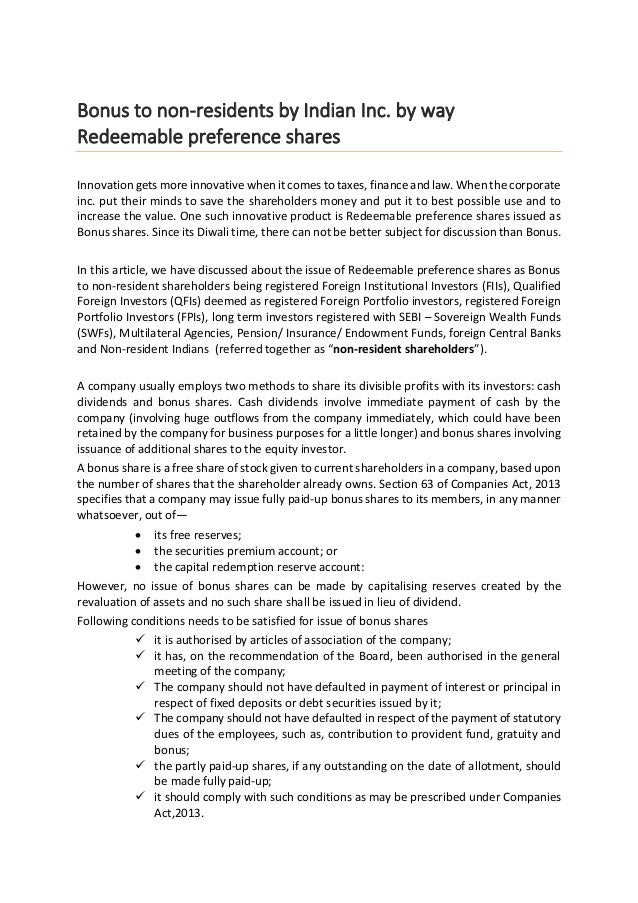

Redeemable preference shares are preference shares with a buy back option meaning the company may buy back the preference shares from the holder at a fixed price either at the option of the holder or of the company.

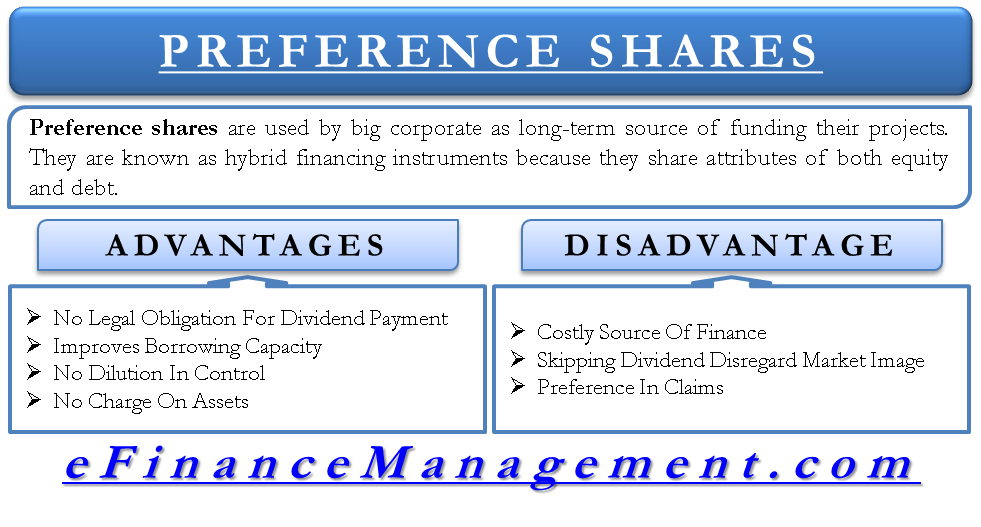

Redeemable convertible preference shares debt or equity. What are preference shares debt or equity. Distinguishing liabilities from equity including convertible debt. In order to determine whether a preference share constitutes a financial liability equity or a compound instrument containing elements of both it is necessary to analyse the terms relating to redemption and the payment of dividends i e. In determining whether a mandatorily redeemable preference share is a financial liability or an equity instrument it is necessary to examine the particular contractual rights attached to the instrument s principal.

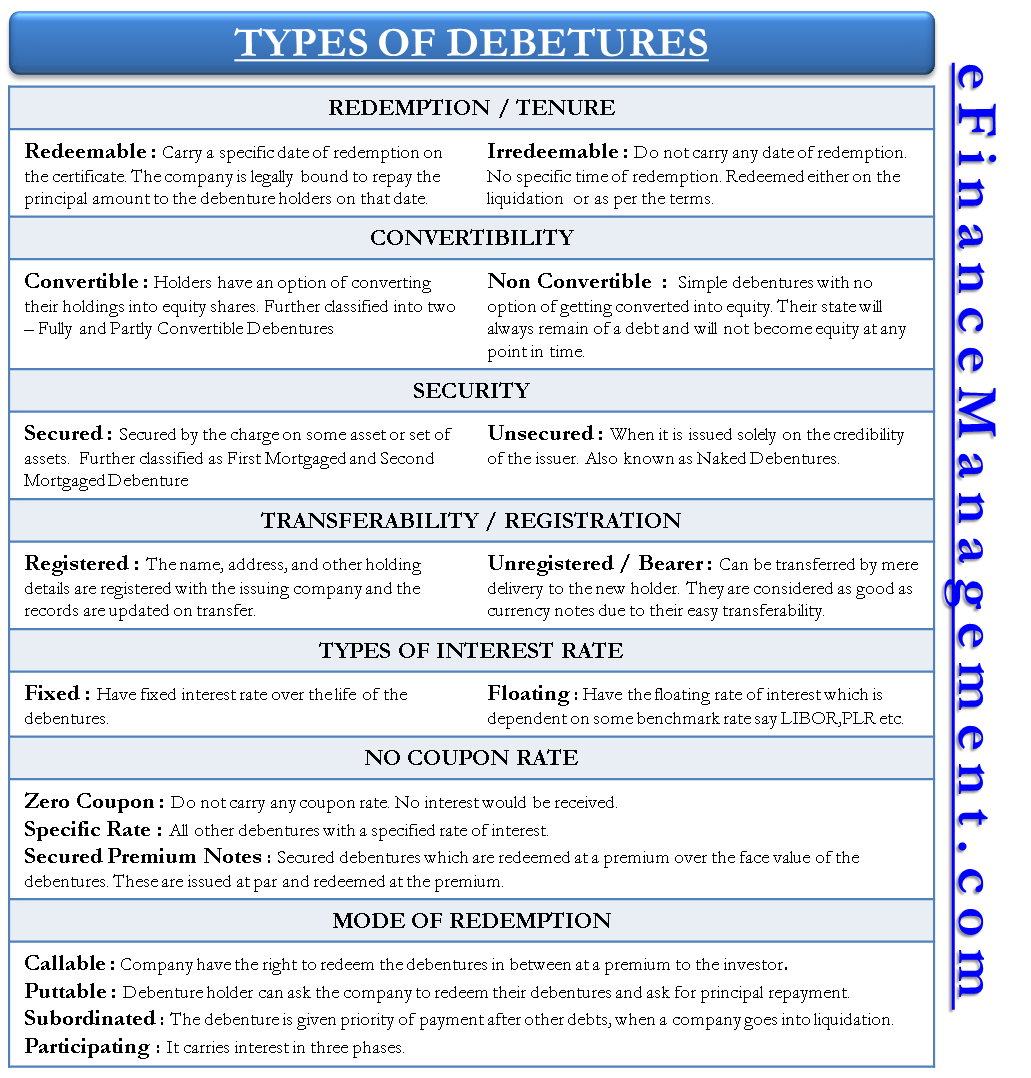

The reserve bank imposed a penalty of 2 crore on kotak mahindra bank on 7 th june 2019 for not complying with its directions regarding dilution of promoters shareholding in the company. All other convertible debt convertible preferred shares. With a convertible redeemable share the investor can exchange the stock for common stock in the company. It is mandatorily redeemable or redeemable at the option of the holder at a fixed or determinable amount at a fixed or future date.

The extent to which there is a contractual obligation of the issuer of the shares to deliver cash or another financial asset to the holder. Special types of preference shares. It is non convertible to ordinary shares of the entity. For example a preference share that is redeemable only at the holder s request may be accounted for as debt even though legally it is a share of the issuer.

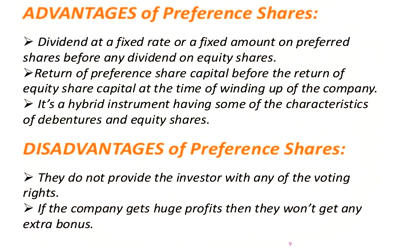

The terms redeemable shares and convertible shares refer to different types of preferred stock. There are two special types of preference shares. If a preferred stock is redeemable it means that the issuing company can exchange those shares. This could be because the substance of the terms and conditions requires the issuer to deliver cash or another financial asset to settle a contractual obligation.

A redeemable stock allows a company to purchase the stock back at a future date. As with preferred shares convertible bonds may have issue specific factors that can have a significant impact on their investment value. Accounted for as convertible debt with cash. Add back interest and.

The equity option s value on the other hand may respond like shares of stock to changes in the company s business performance increasing or decreasing in value as profit prospects change.