Redeemable Convertible Preference Shares Accounting Treatment

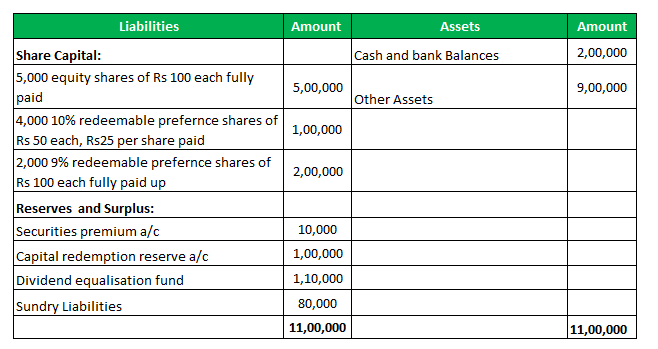

100 each at rs.

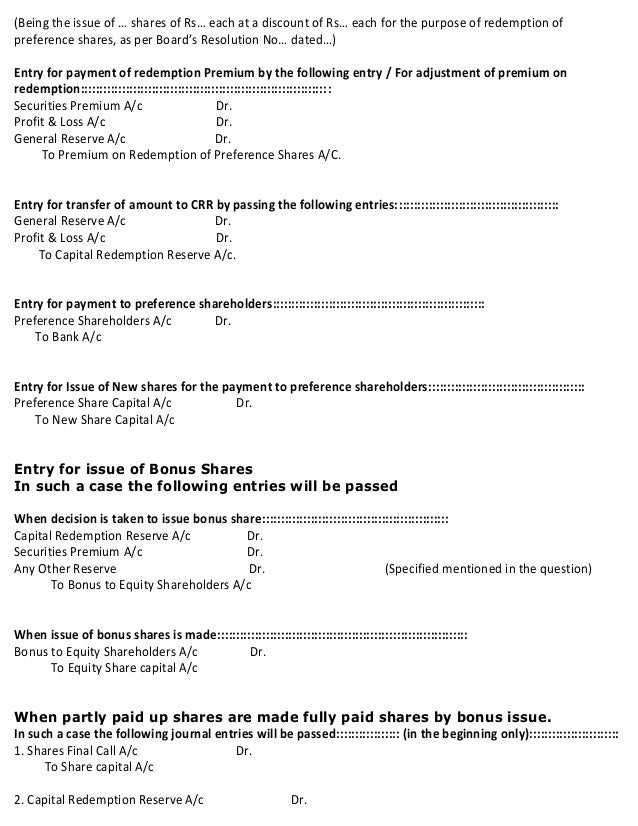

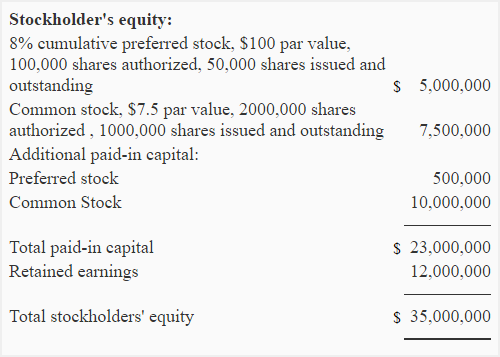

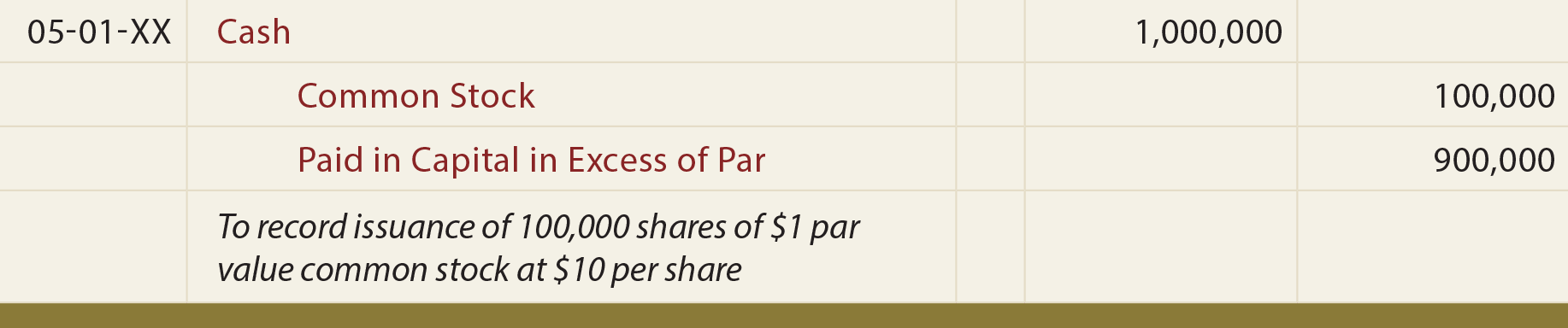

Redeemable convertible preference shares accounting treatment. Only fully paid up redeemable preference shares may be redeemed when there are profits available for such redemption subject to statutory exceptions and a prescribed notice of redemption must be lodged with acra. In determining whether a mandatorily redeemable preference share is a financial liability or an equity instrument it is necessary to examine the particular contractual rights attached to the instrument s principal. The redemption feature tends to set an upper limit on the market price of the stock since. An investment in preference shares may be a basic financial instrument and therefore within the scope of section 11 or an other financial instrument and therefore within the scope of section 12.

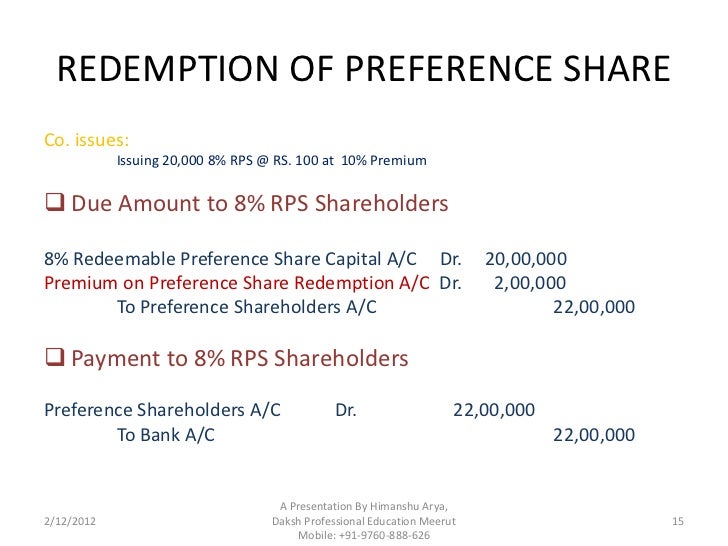

For example this means that a redeemable preference share where the holder can request redemption is accounted for as debt even though legally it may be a share of the issuer. No company limited by shares shall after the commencement of the companies amendment act 1996 issue irredeemable preference shares or redeemable preference shares which are redeemable after 20 years of its issue. However some restrictions apply to redemption. Shares already issued of other type can not be converted into redeemable preference shares.

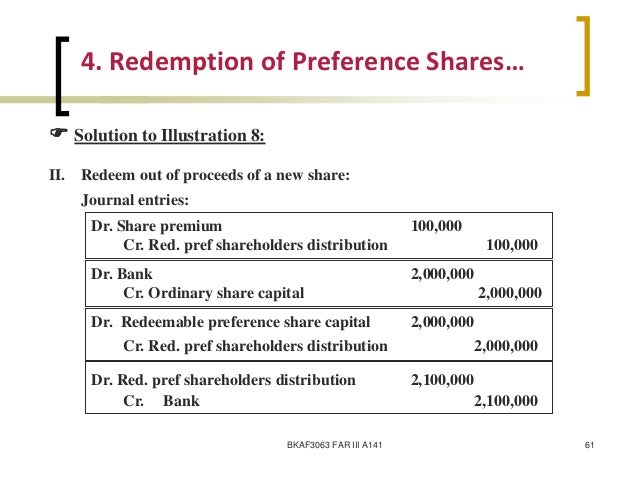

Redeemable preferred stock is a type of preferred stock that allows the issuer to buy back the stock at a certain price and retire it thereby converting the stock to treasury stock these terms work well for the issuer of the stock since the entity can eliminate equity if it becomes too expensive. This is an interesting fact that although they are termed as shares but in nature they are liability as entity has to retrieve the shares at a particular date by paying agreed amount to the holder of redeemable shares. These returns cover a period from 1986 2011 and were examined and attested by baker tilly an independent accounting firm. 105 on december 31 2012.

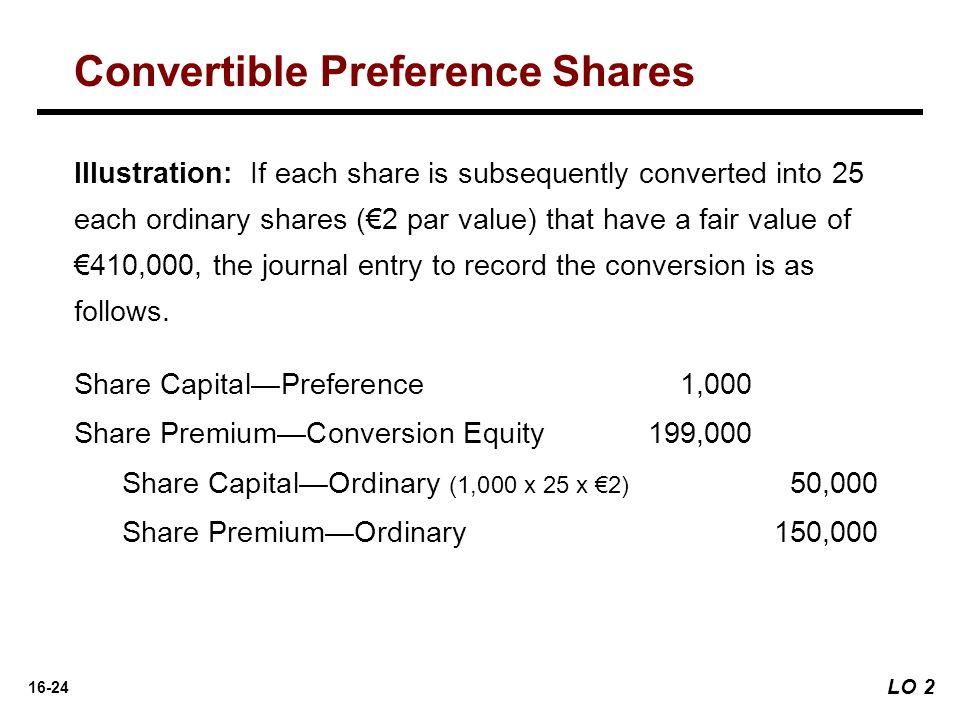

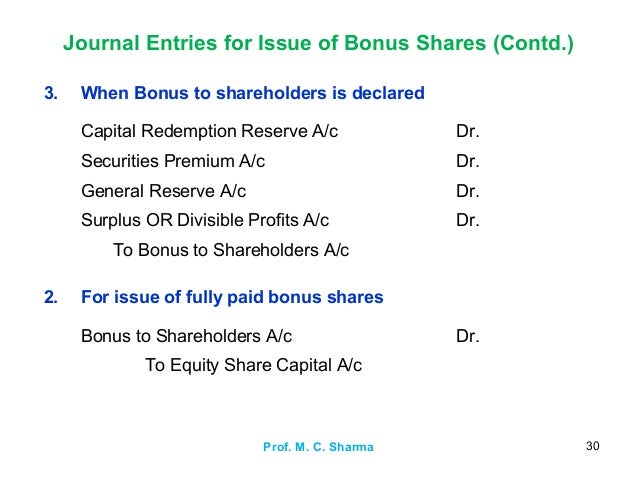

The terms of issue provide for a the conversion of rs. Convertible or redeemable preference shares are issued according to the terms set by the company at the time of subscription. An investment in preference shares is a financial asset typically presented as a fixed asset investment and the accounting is determined by sections 11 and 12 of frs 102. When you invest in redeemable convertible preference shares.

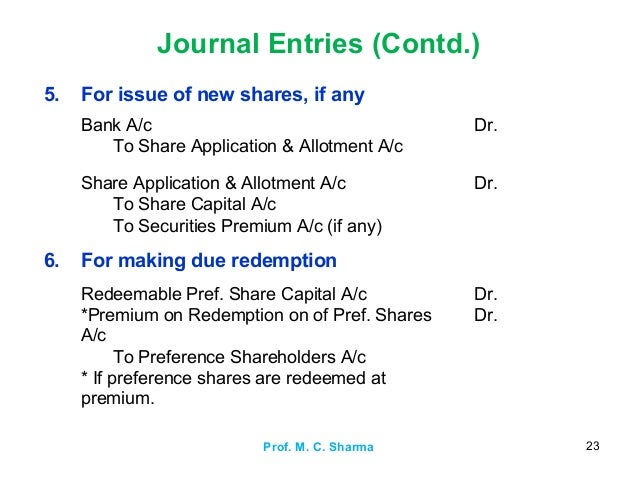

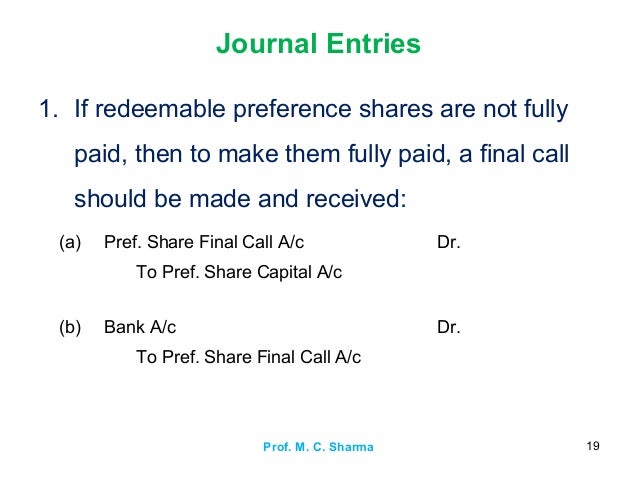

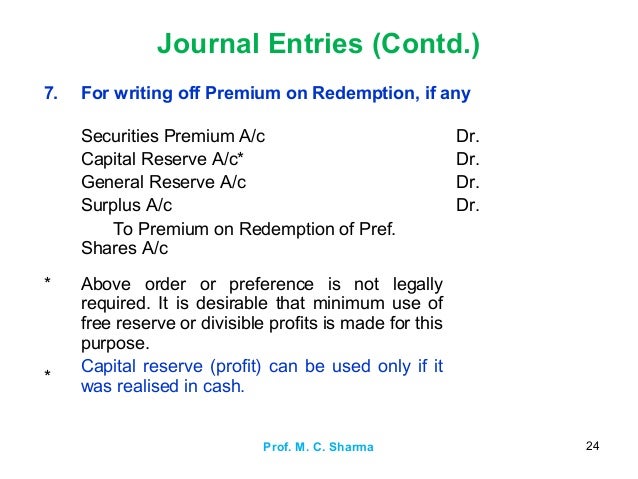

Accounting treatment for redeemable preference shares if preference shares are redeemable then shares are reported as liability in statement of financial position. 100 each on december 31 2014 and b the redemption of remaining preference shares at rs. 3 00 000 preference shares into equity shares of rs.