Islamic Credit Card Vs Conventional Credit Card

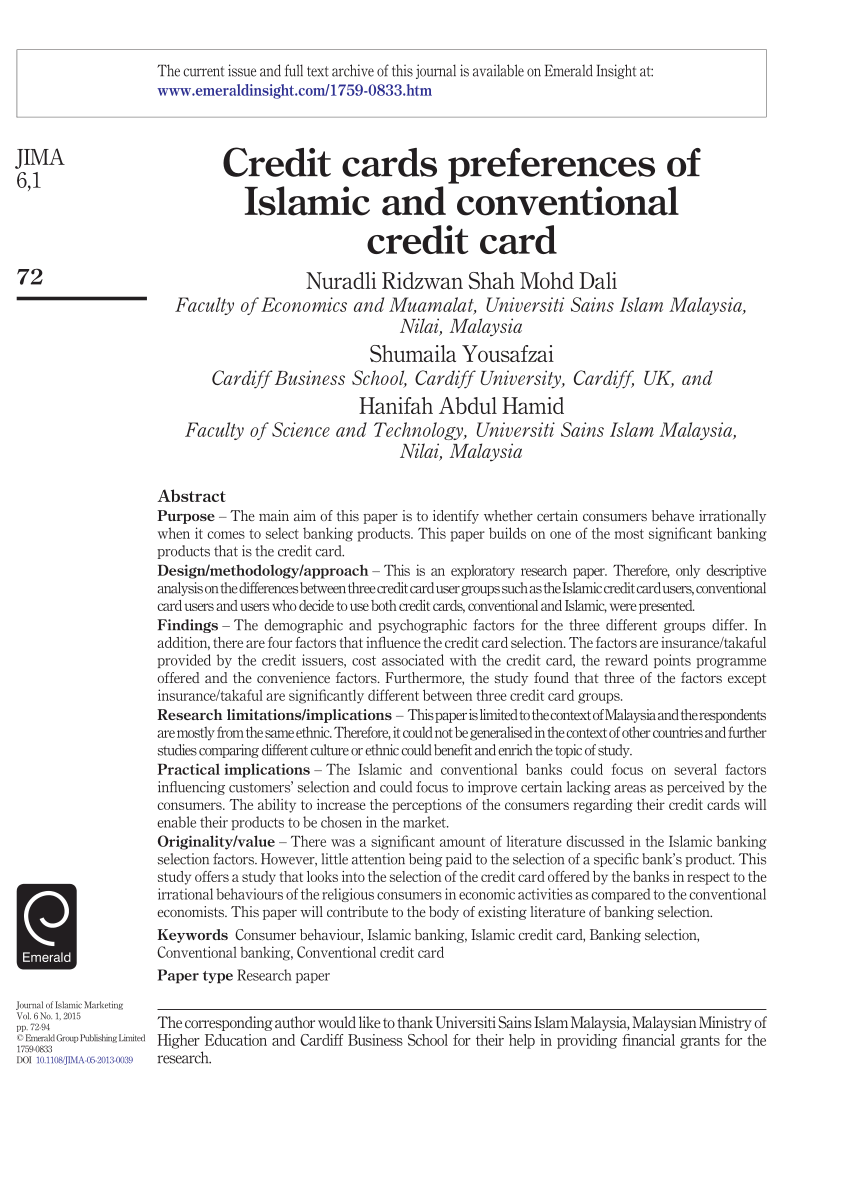

Card users and users who decide to use both credit cards conventional and islamic were presented.

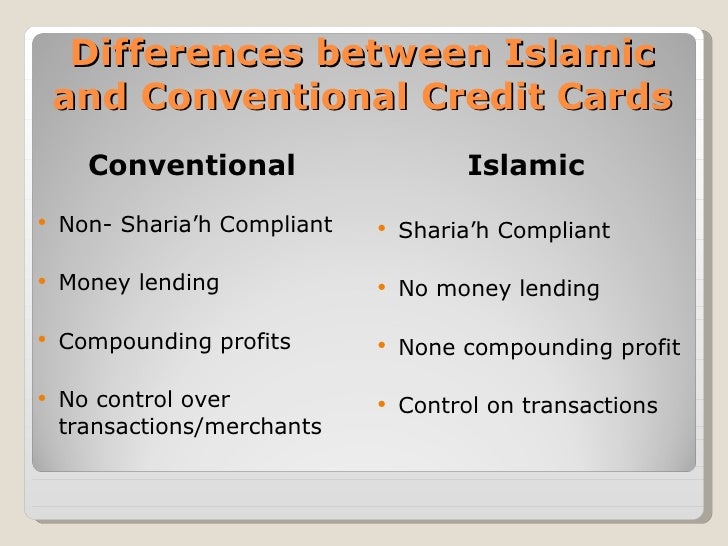

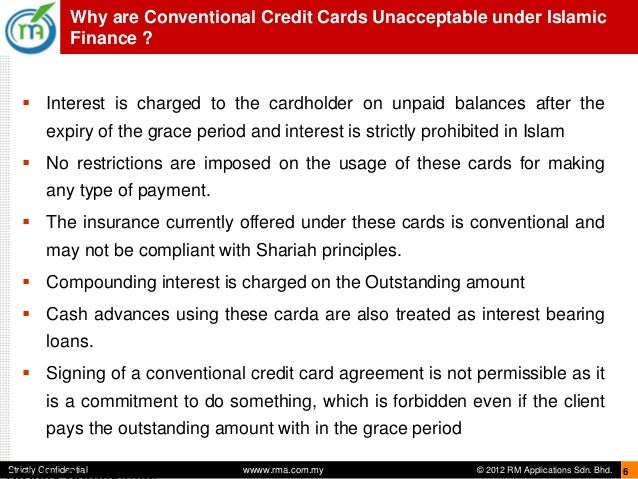

Islamic credit card vs conventional credit card. Bonus points gifts shopping discounts travelers cheques etc. Islamic credit card compared to the conventional credit card while 5 are of the opinion that there are no differences betwe en the two types of c redit cards. Bank interest is always considers as an issue in mankind history if we exclude banks history from there. Islamic credit cards need to be shariah compliant and free from any activities that are deemed as unlawful in islam.

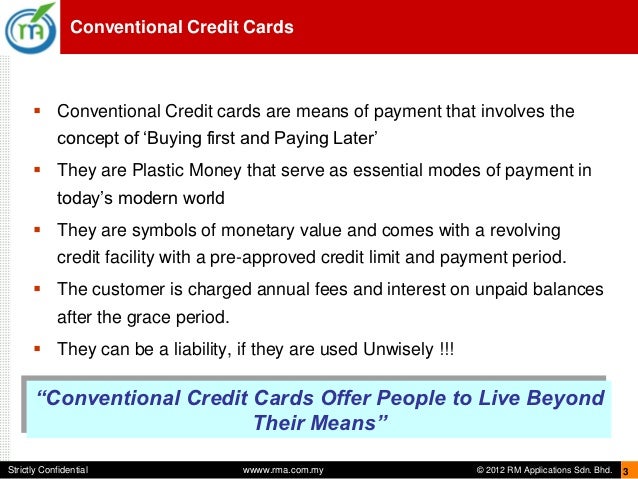

Issues and alternative solutions. 1 when a merchant accepts a credit card payment a percentage of the sale goes to the card s issuing bank. How it differs islamic vs conventional credit cards. For the bank issuing the credit card the motivation is two fold.

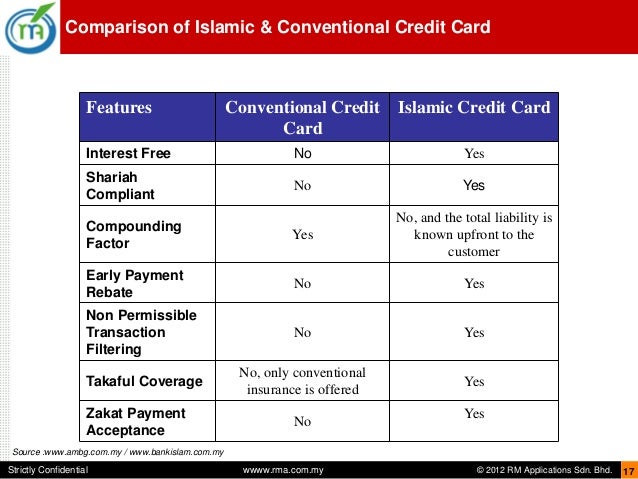

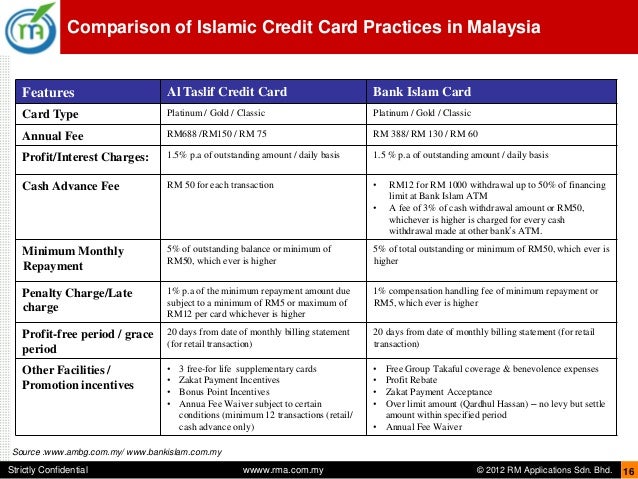

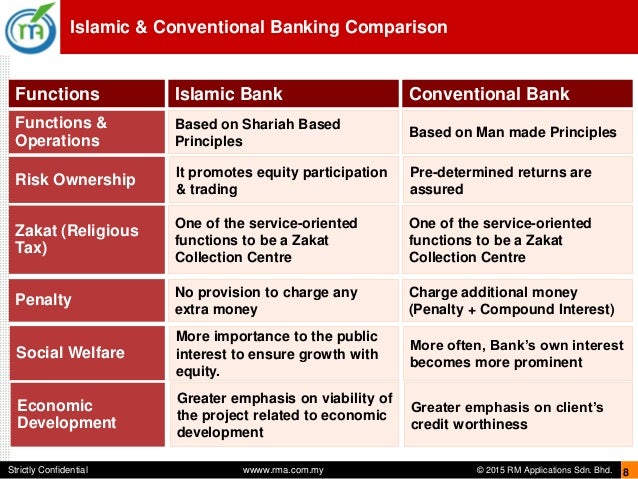

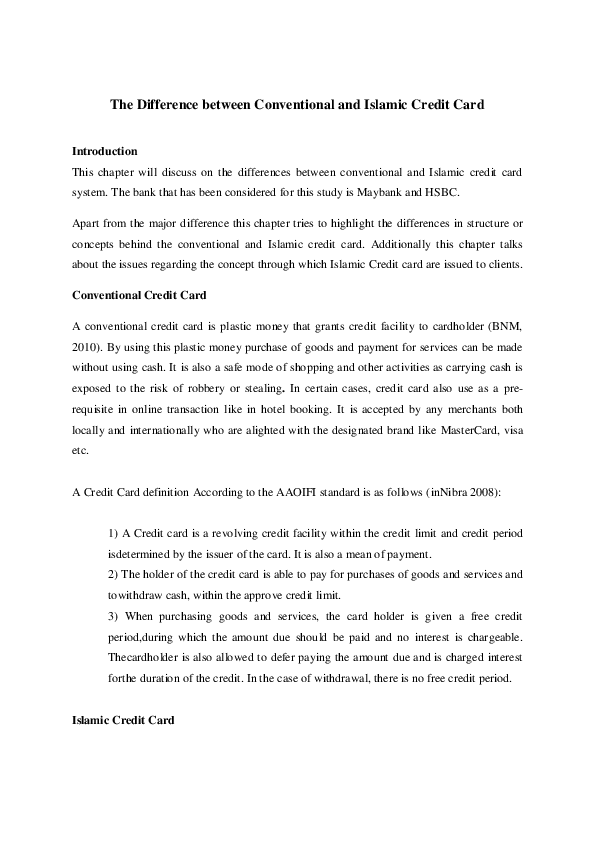

May 11 2009 in islamic banking. The difference between conventional and islamic credit card. Shari ah credit cards consist of three permissible contract structures that make it different from a conventional credit card namely kafalah wakalah and qard. An islamic credit card functions similarly to a conventional credit card but with some slight differences in the offered features.

This product is open to muslims as well as non muslims. Credit card conventional vs islamic. Otherwise the payment to the card issuer can be made from cash funds obtained from an islamic bank through tawarruq murabaha with the cash funds repayable on a deferred payment basis. A credit card is a card that allows you to borrow money from a bank to make purchases.

You may enjoy the value added benefits of conventional credit cards e g. A small fee may be charged annually for the credit card. The main differences between islamic credit cards and conventional credit cards are the prohibition of gharar and riba gharar is overcharging while riba is interest. In fact many non muslims now use these cards to take advantage of their unique features and fantastic.

Who can apply for an islamic credit card. Features on islamic credit card. Islamic credit cards can be enjoyed by both muslims and non muslims. Findings the demographic and psychographic factors for the three different groups differ.

Islamic banking 101 so what makes a credit card islamic.