Islamic Credit Card Concept

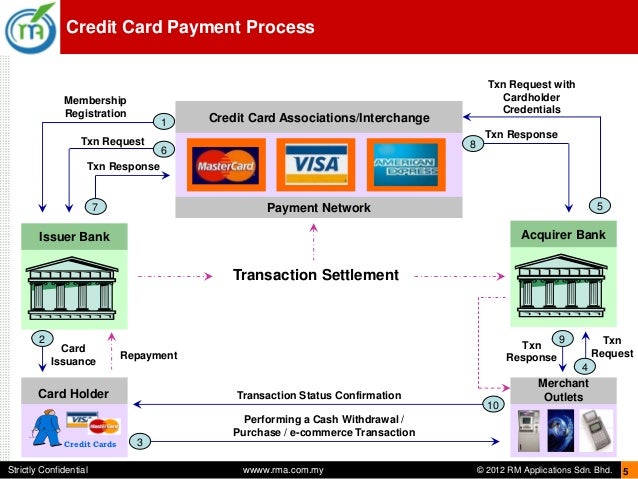

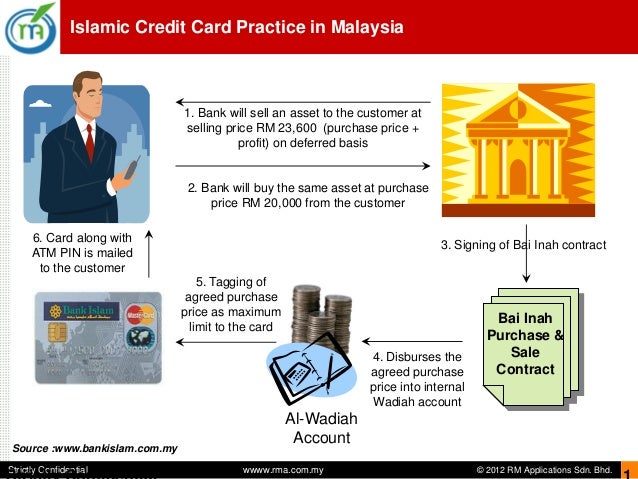

As goods are purchased using this credit card the bank will render the transaction on your behalf and simultaneously sell it back to the customer.

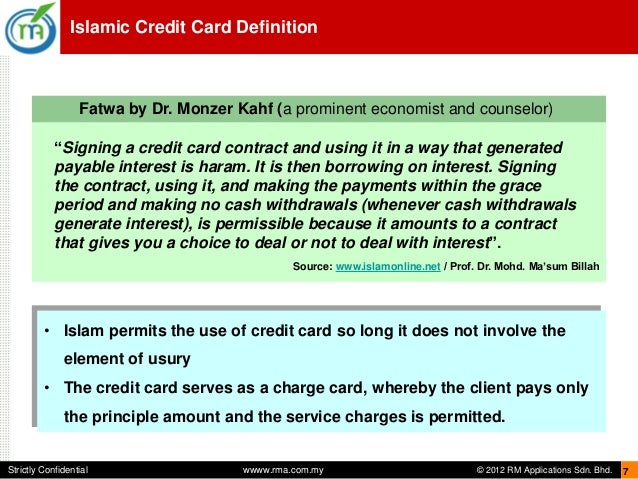

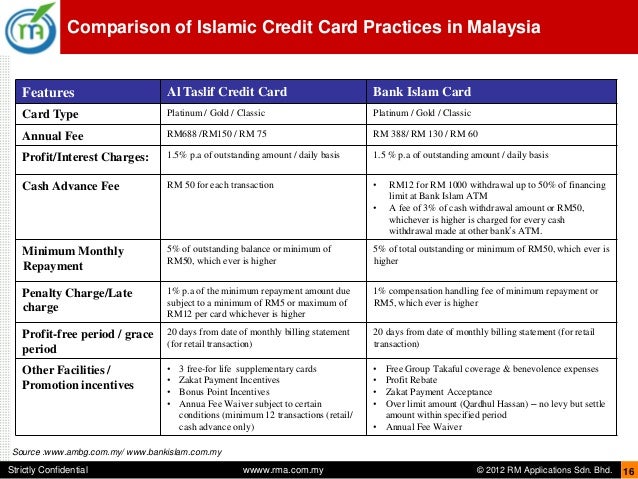

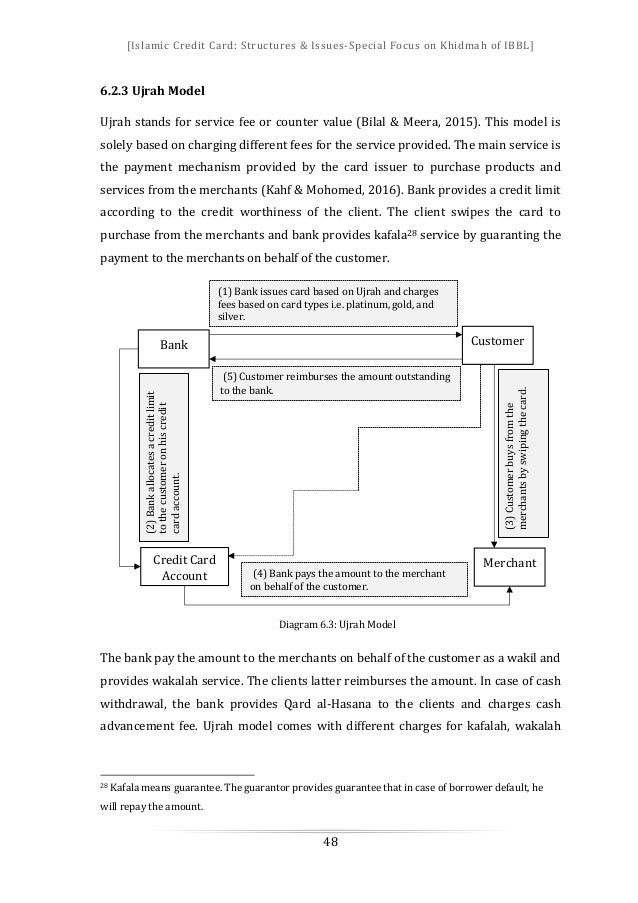

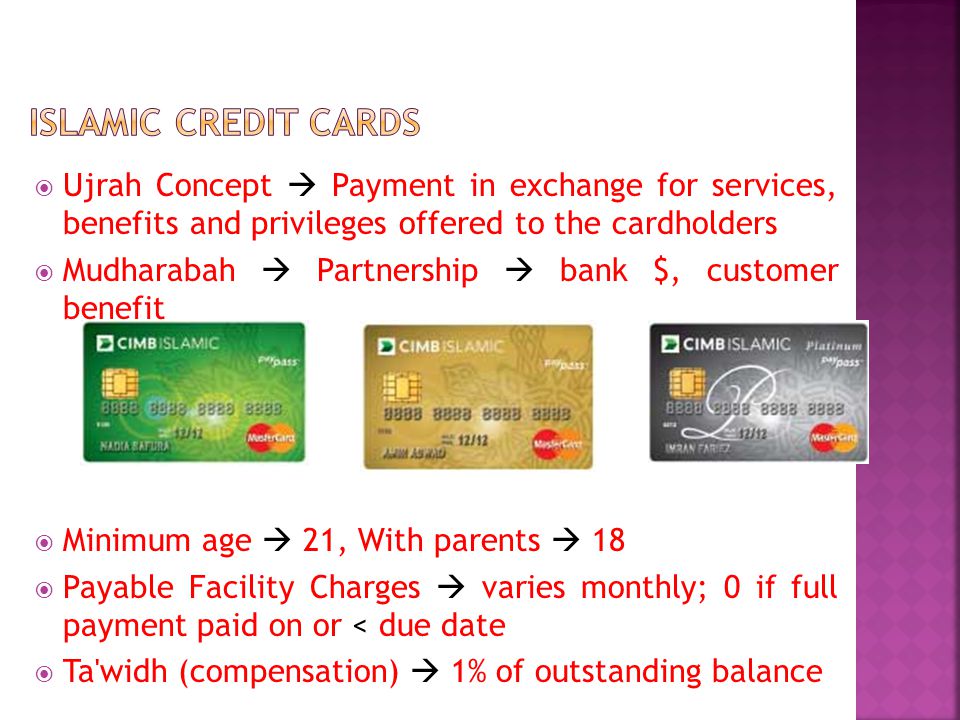

Islamic credit card concept. During that time ambank employed bay al inah principle to govern its credit card transactions while bimb s. Bank offer a credit card balance transfer with 0 interest rate but 3 5 handling charges which option is closer to islamic finance if at all. Ujrah the shariah concept of ujrah used by islamic banks refers to payment of a service fee in exchange for the services rendered to customers and most islamic credit cards in malaysia are based on this concept. Is free from the elements of riba gharar and gambling.

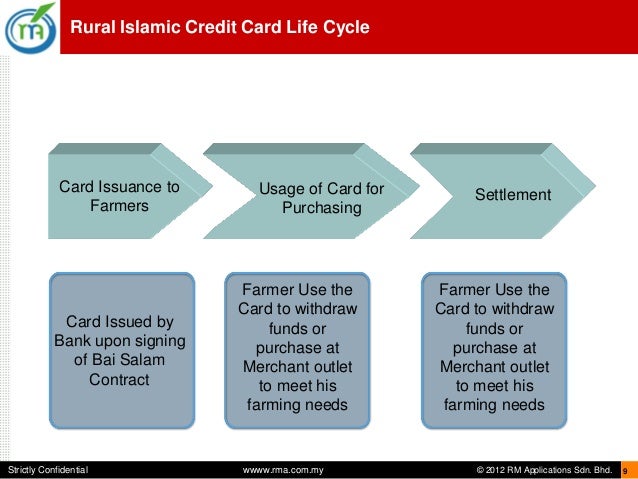

Using an islamic card also allows you to make upfront purchases and pay for all of it on a later date. One of the latest banking products offered by islamic institutions is the islamic credit card. However islamic credit cards function on different fundamentals as conventional banking cards do. The islamic credit card is a new way o f.

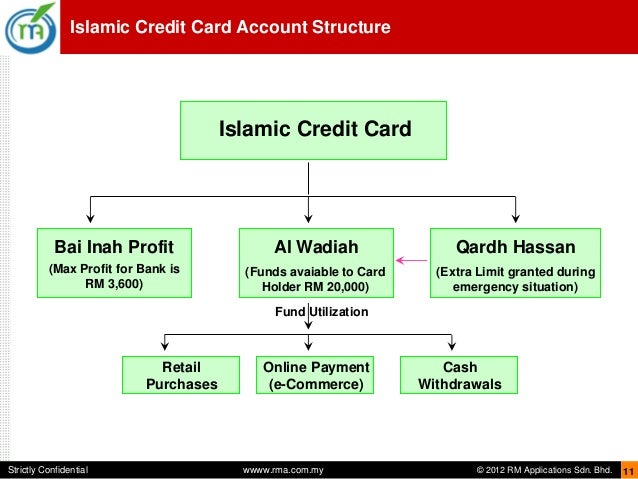

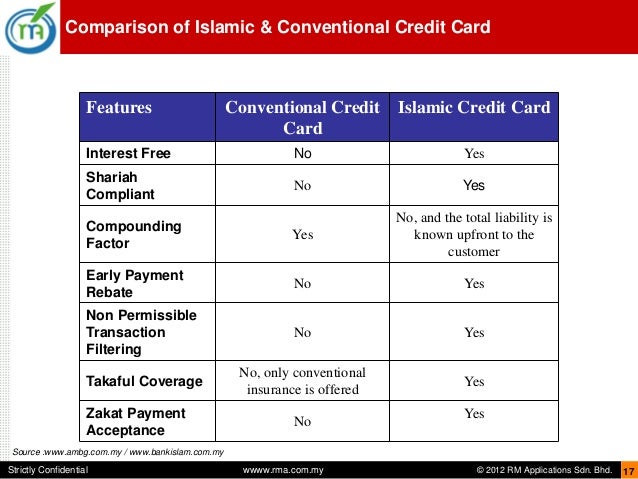

The advanced nature of a conventional credit card with many built in features rewards mechanism and credit limit flexibility which runs hand in hand with a robust penalty system for defaulters does not make the development of its islamic version any easier. On this concept on giving it away to charity the interest for investments card. Financing individual in the market of islamic banking. Shari ah credit cards consist of three permissible contract structures that make it different from a conventional credit card namely kafalah wakalah and qard.

However it is usually used specifically in relation to a fee charged in exchange for a service. In history ambank was the first bank to introduce an islamic credit card known as the ambank al taslif credit card on 30th september 1996 followed by bimb known as bank islamic card bic on 23rd july 2002. Examples of islamic credit card that uses this concept in malaysia is bank islam s platinum visa credit card i and gold classic credit card i. Examples of islamic credit card that uses this concept in malaysia is bank islam s platinum visa credit card i and gold classic credit card i.

Ujrah is a generic term in arabic that translates to fee. Using the principles of al bai bithaman ajil deferred payment sale the bank issues an interest free and penalty free credit card. Otherwise the payment to the card issuer can be made from cash funds obtained from an islamic bank through tawarruq murabaha with the cash funds repayable on a deferred payment basis. An islamic credit card varies from a conventional banking credit card but essentially both cards carry out the same function.

The islamic credit card is defined as a means of electronic payment including a deferred payment respecting the principles of islamic law and guided by the rules of islamic finance which bans any interest bearing revolving credit facility.