Development Of Islamic Finance In Malaysia

Follow all updates and access malaysia specific islamic finance information and data here.

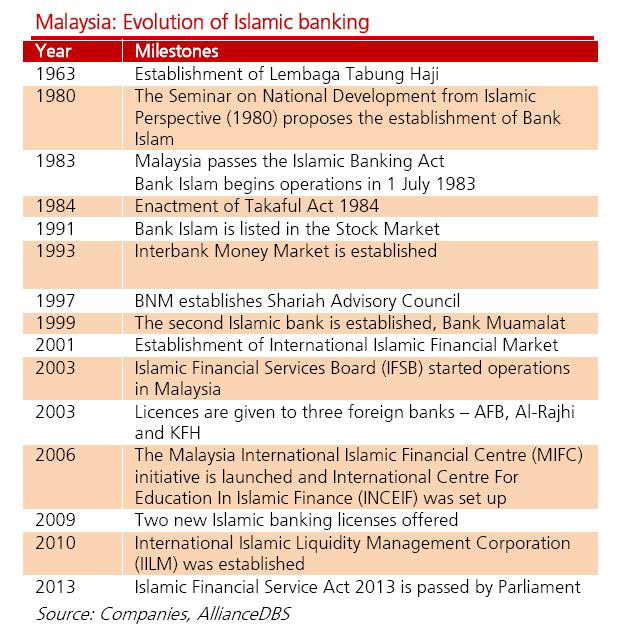

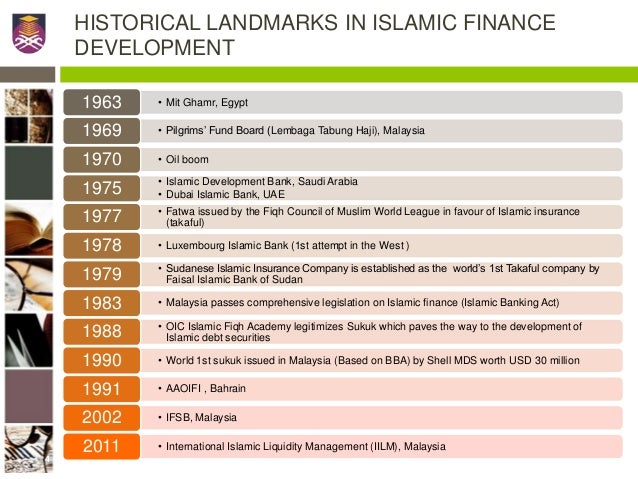

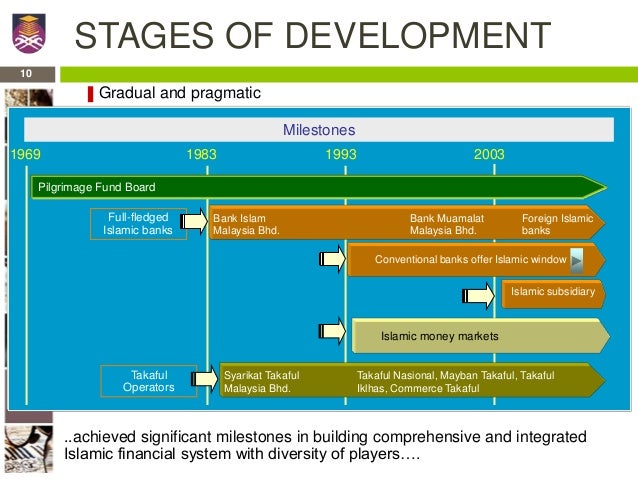

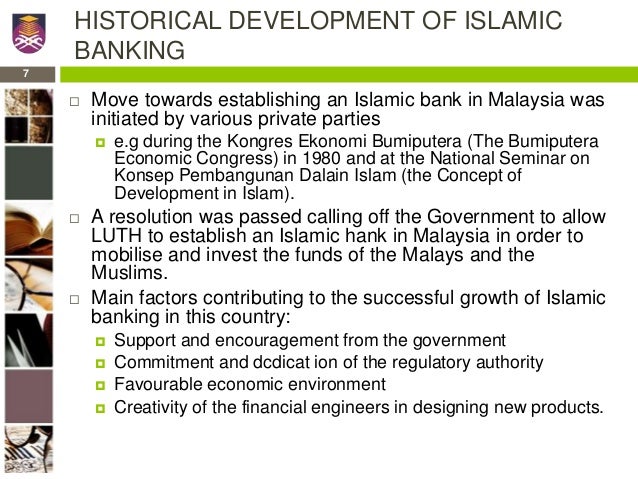

Development of islamic finance in malaysia. It plays an important role in generating economic growth for the country. What are dfis the dfis in malaysia are specialised financial institutions established by the government with specific mandate to develop and promote key sectors that are considered of strategic importance to the overall socio economic development objectives of the country. In the face of significant financing needs for the sdgs islamic finance has untapped potential as a substantial and non traditional source of financing for the sdgs. The islamic financial system in malaysia has witnessed a tremendous growth in demand acceptance and development since its introduction in 1963.

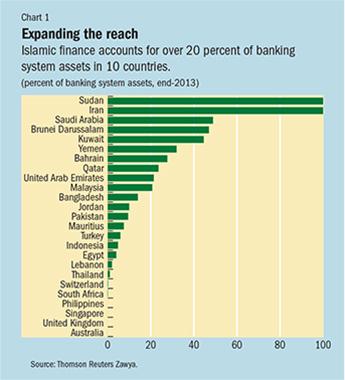

By 2015 the industry had surpassed us 1 88 trillion in size. Examples of accounts balance sheet income statement 5. Malaysia is the leading international centre for islamic finance. Overview of development financial institutions dfis in malaysia.

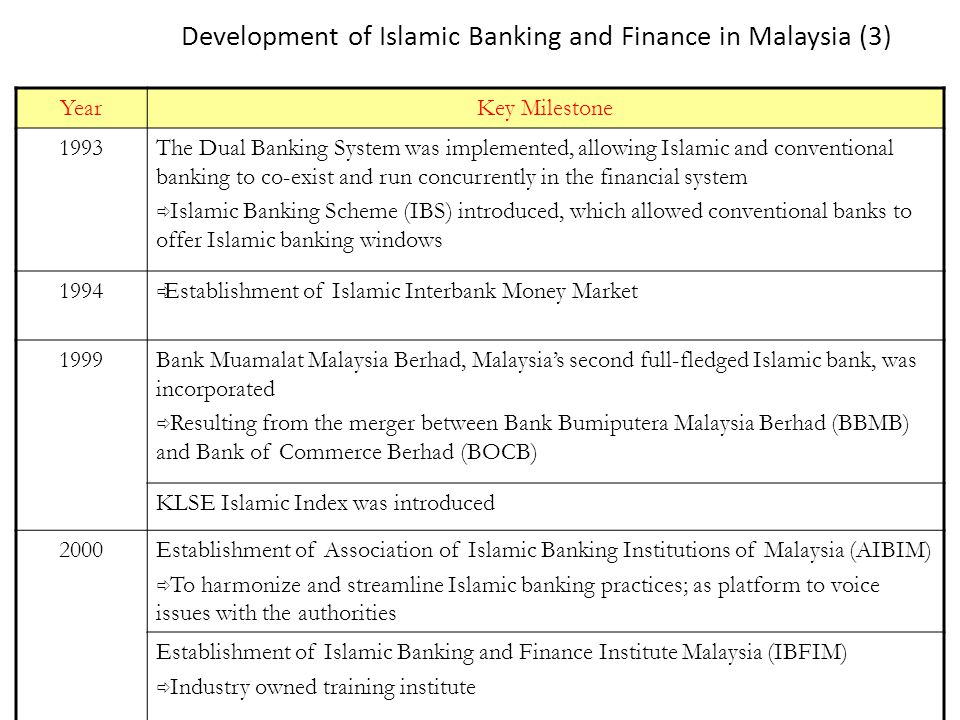

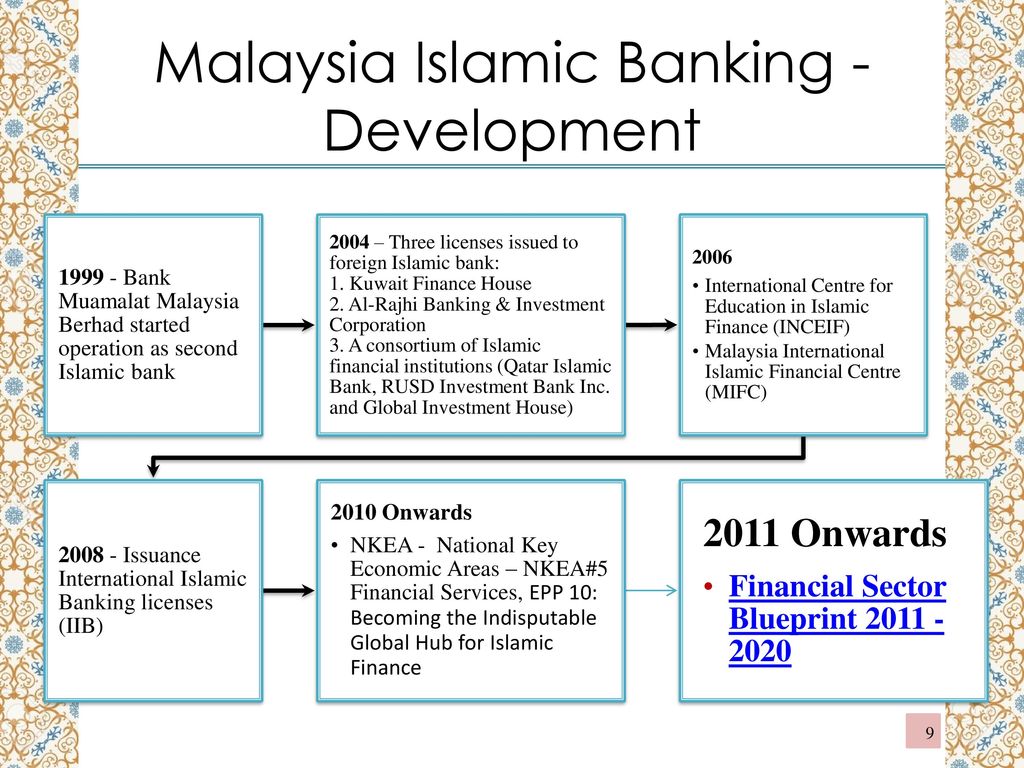

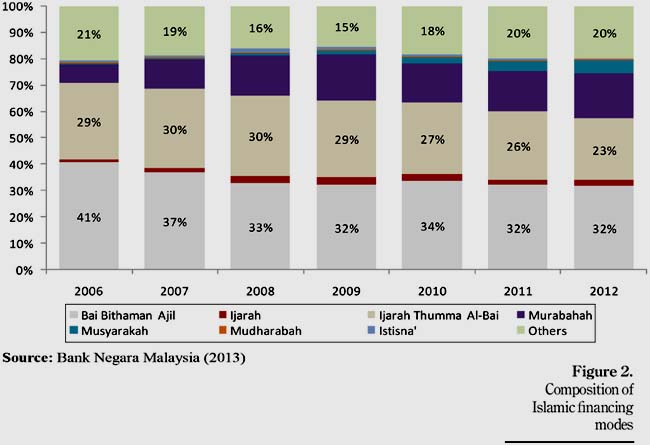

The growth of islamic finance has been rapid at 10 12 annually over the past two decades. Islamic finance is a relatively young but fast developing area of finance in recent times. The icm functions as a parallel market to the conventional capital market and plays a complementary role to the islamic banking system in broadening and deepening the islamic financial markets in malaysia. It began with the establishment of the malaysian pilgrims fund board tabung haji and the country s first islamic bank bank islam malaysia berhad bimb which began operations on 1 july 1983.

The icm is a component of the overall capital market in malaysia. Although the concept is as old as the religion itself modern shari ah banking and investment industry really took off in the 1960s with the launch of the social bank in egypt and started to grow exponentially in the 1970s and 1980s with the development of islamic banks in gcc countries for examples. In 1969 the conference of the conference of rulers of malaysia decided that there was a need for a body to mobilize the development and progress of muslims in malaysia in line with the status of malaysia as a growing islamic country and gaining international attention. Islamic finance development development of the islamic banking sector creating an impact on society and economy through value based intermediation vbi the islamic banking industry in malaysia has advanced significantly over the years.