Development Of Islamic Banking And Finance In Malaysia

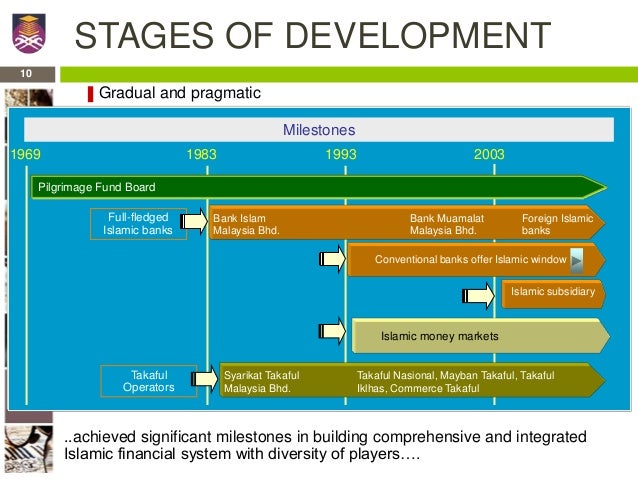

Pwsbh was set up as an institution for muslims to save for their hajj pilgrimage to mecca expenses.

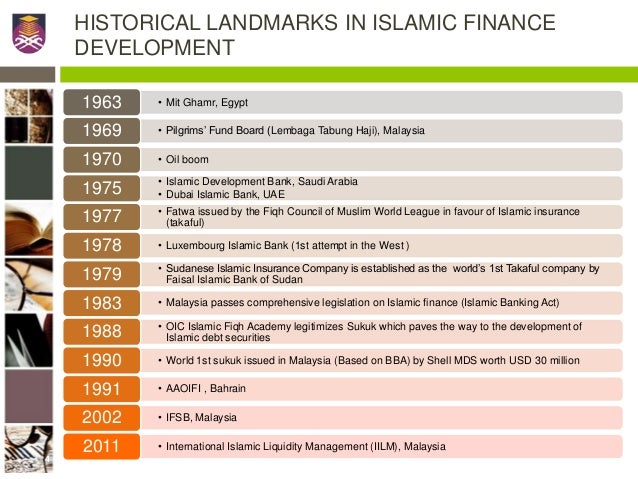

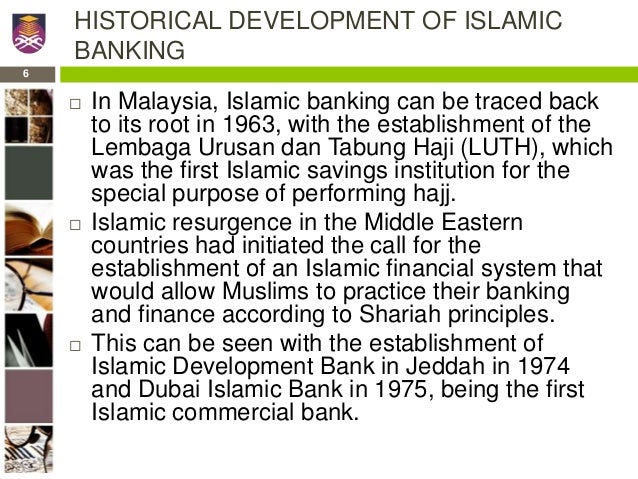

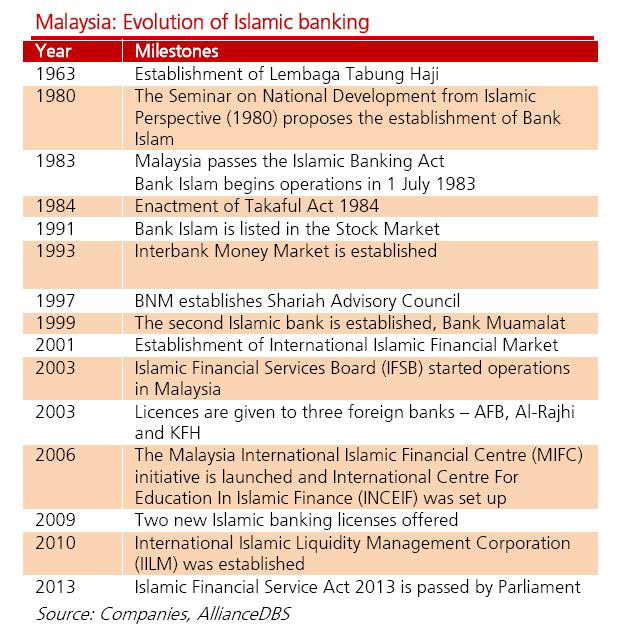

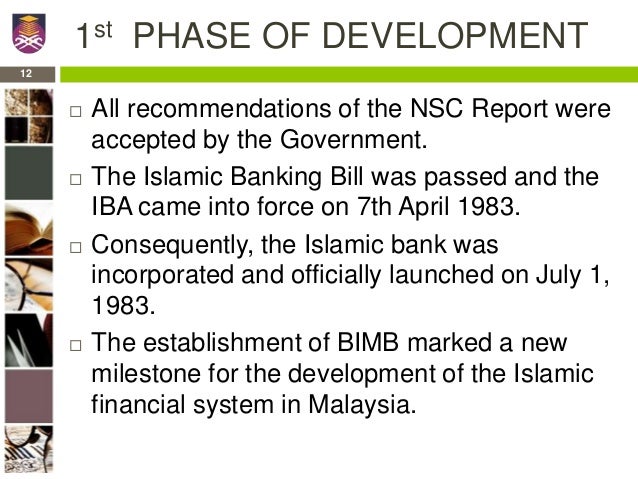

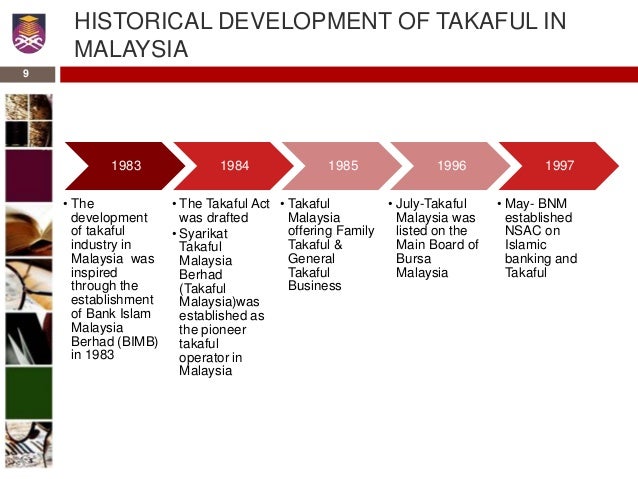

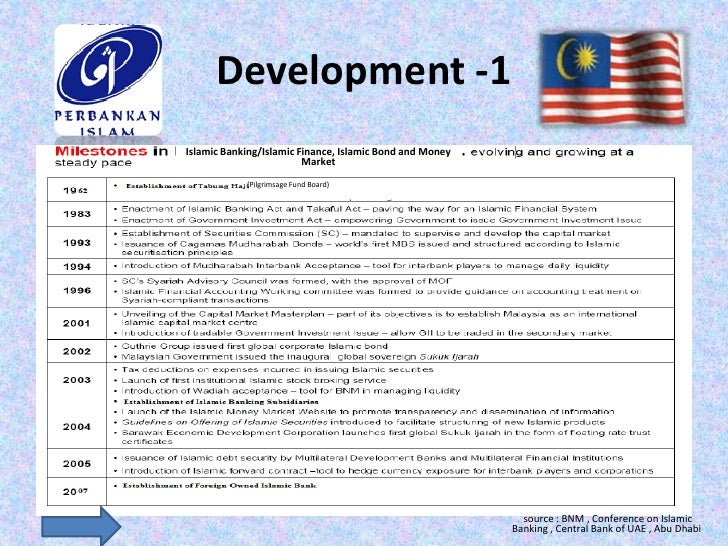

Development of islamic banking and finance in malaysia. It began with the establishment of the malaysian pilgrims fund board tabung haji and the country s first islamic bank bank islam malaysia berhad bimb which began operations on 1 july 1983. Malaysia is home to a vibrant islamic banking sector. Islamic banking in malaysia began in september 1963 when perbadanan wang simpanan bakal bakal haji pwsbh was established. Islamic finance has grown rapidly in the past two decades and it now stands as a potential contributor in supporting the sustainable development goals.

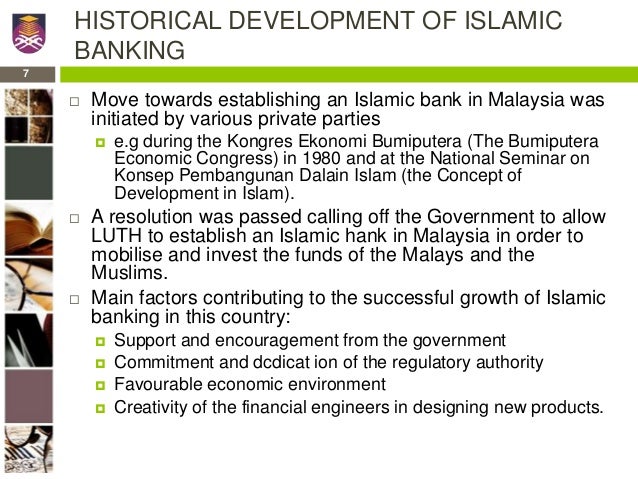

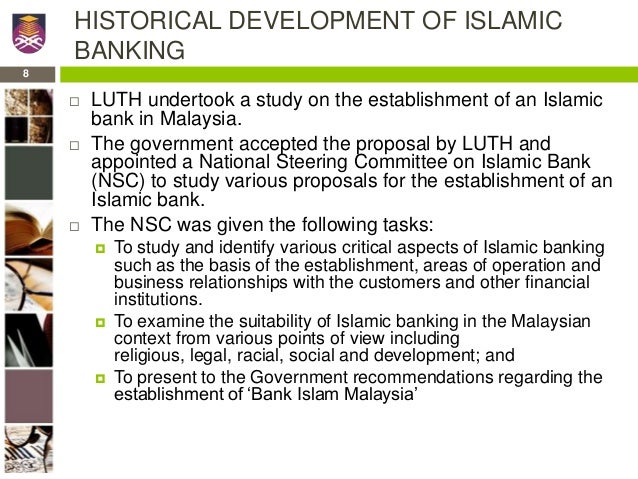

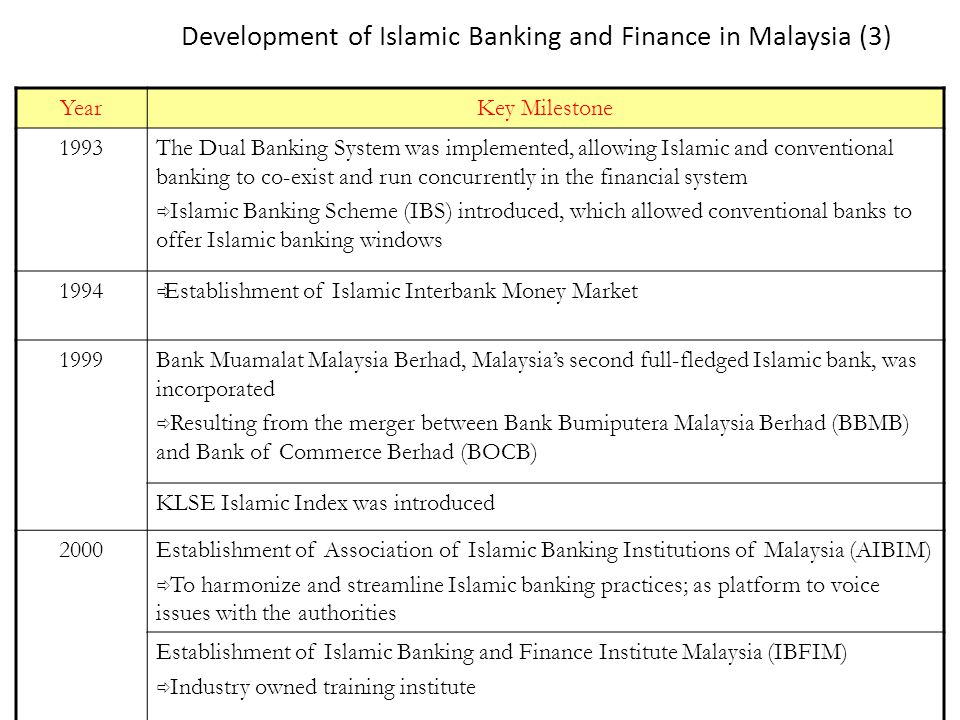

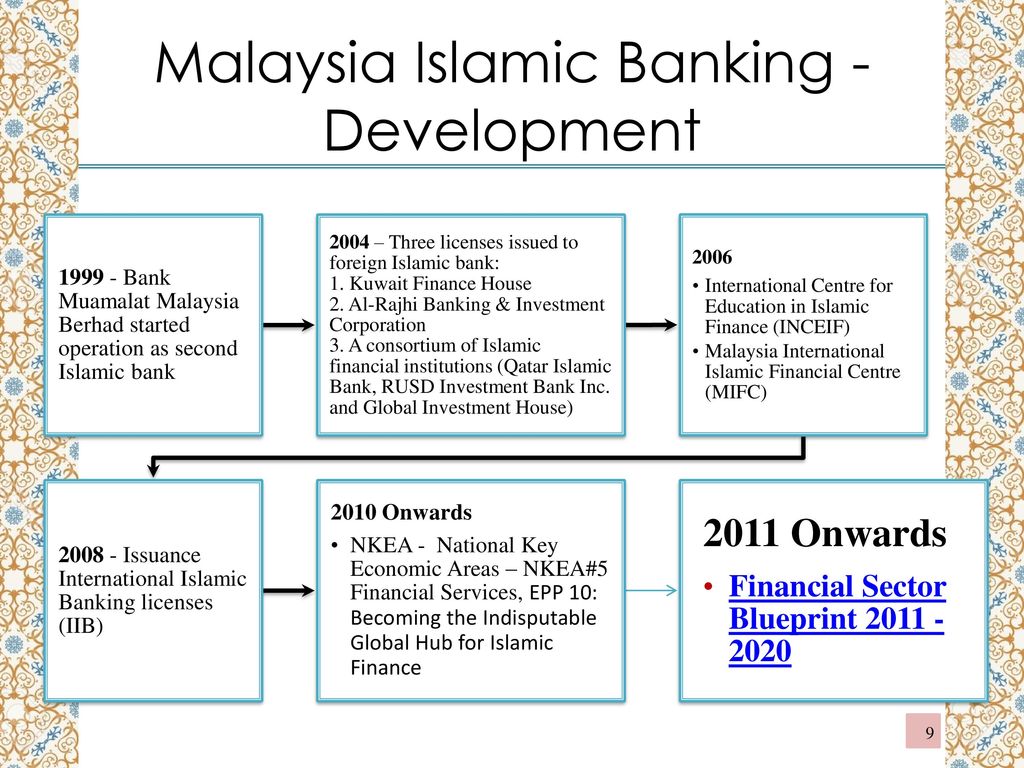

The enactment of the islamic banking act 1983 enabled the country s first islamic bank to be established and thereafter with the liberalisation of the islamic financial system more islamic financial institutions have been established. In 2008 islamic banking accounted for 7 1 per cent of malaysia s financial sector. From a market share of 5 3 in 2000 islamic financing now accounts for 34 9 of total loans and financing. This paper will focus on the historical development of islamic banking in malaysia from the creation of the haj pilgrim s fund board in the 1960s to the current islamic banking scene of 17.

The establishment of bank islam in malaysia is a significant 1. South east asia journal of contemporary business economics and law vol. Islamic finance development development of the islamic banking sector creating an impact on society and economy through value based intermediation vbi the islamic banking industry in malaysia has advanced significantly over the years. Malaysia s islamic finance industry has been in existence for over 30 years.

The islamic financial system in malaysia has witnessed a tremendous growth in demand acceptance and development since its introduction in 1963. Malaysia has also placed a strong emphasis on human capital development alongside the development of the islamic financial industry to ensure the availability of islamic finance talent. Bigstock joyful islamic finance has the potential to play a crucial role in supporting the implementation of. While almost every islamic banking practitioner has followed the growth of islamic banking in malaysia in recent years my move to malaysia five.

The islamic banking and finance industry in malaysia is developing progressively primarily due to the concerted effort from the regulators and the industry players alike. 10 issue 1 aug issn 2289 1560 2016 of development of islamic banking in. By 2016 that figure had leapt to 28 per cent and the malaysian government hopes to push it over 40 per cent by 2020.