Challenges Of Islamic Banking

Countries like malaysia bahrain and oman have developed separate legal and regulatory frameworks for islamic banks to follow while qatar has aimed to separate islamic banking from conventional banking by banning islamic windows within conventional branches.

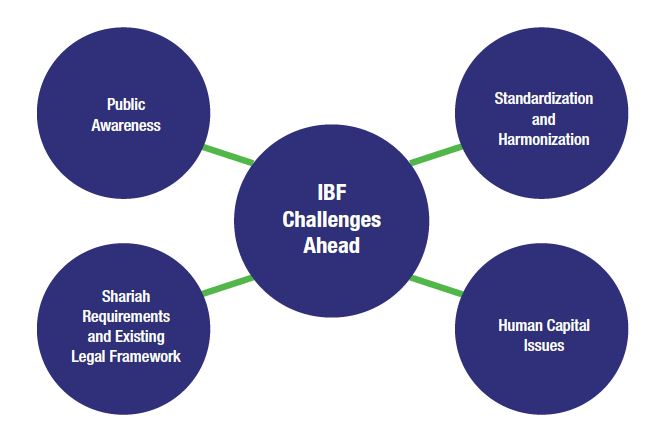

Challenges of islamic banking. For each 1 unit changes in concentrated banking limited risk management functionality the challenges of islamic banking and financial institutions in malaysia will changes 0 439 units. One study of which modes of islamic finance were used most frequently found pls financing in leading islamic banks had declined from 17 34 in 1994 6 to. The initial effort to engage in islamic banking in the philippines was made in 1973 with the establishment by presidential decree of the al amanah islamic bank of the philippines. Shortage of experts in islamic banking.

The signature of. Co efficient result for misunderstanding and lack of. 4 5 3 misunderstanding and lack of standardization of islamic financial concept table 4 18. Covid 19 establishes a new platform for evaluating how islamic banking responds to economic chaos.

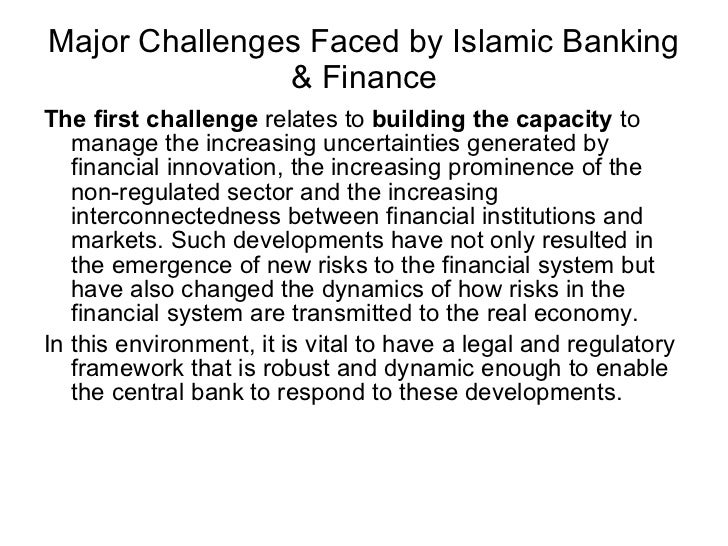

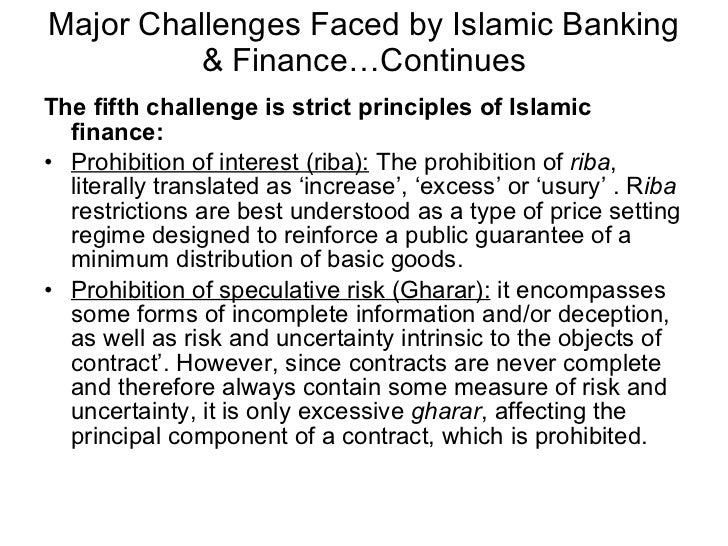

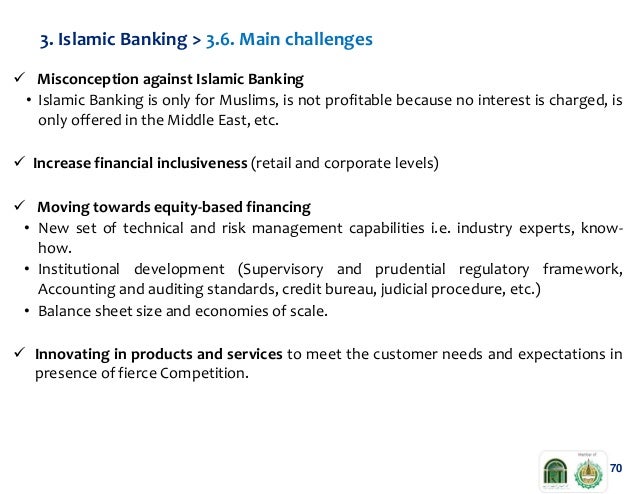

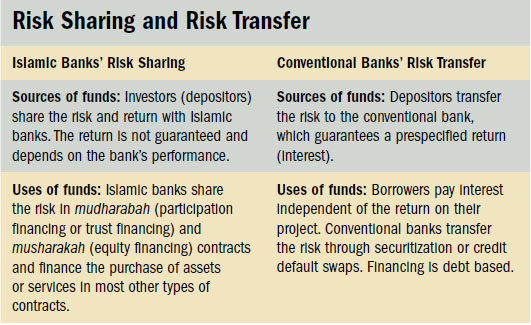

The industry realises this challenge and certain countries and governments have fostered the development of the islamic banking sector. As commercial banks across the world find themselves on the brink of crisis while the global pandemic halts financial transactions among civil society the islamic banking system faces unconventional challenges. Islamic law offers its own framework for execution of commercial and financial. Some of the most important challenges facing the islamic banking industry are identified as follows.

To be consistent with islamic banking rules. In spite of the growth potential in islamic banking there are several challenges facing islamic financial institutions.